Do you remember the first time you wrote a check for $100?

The first $100 check I wrote was for my cell phone waaayyy back in 1997. Whoa….that brings back memories.

What about your first, $1,000 check? Even better, your first $10,000 check?

The first time I wrote a check for $10,000 was to pay off my student loan debt. That was, by far, the best check I ever wrote!

It’s not too often that you have an extra $10,000 lying around, but if you did it would definitely be a good problem to have.

But the answer as to what to do with the money isn’t always clear. Allow me to suggest a few ways to invest it – like 15 of them. Here’s 15 ways to invest $10,000.

1. Peer to Peer lending

If you prefer fixed income investments to equities, peer-to-peer lending offers an opportunity to earn interest rates that are well above average. What these sites do is bring lenders (investors) together with borrowers, to create an open lending environment that cuts out the banks, and their high rates and restrictions.

This results in what is often more flexible loan terms for borrowers, and much higher interest rates for investors than what they can get on even long-term certificates of deposit.

This results in what is often more flexible loan terms for borrowers, and much higher interest rates for investors than what they can get on even long-term certificates of deposit.

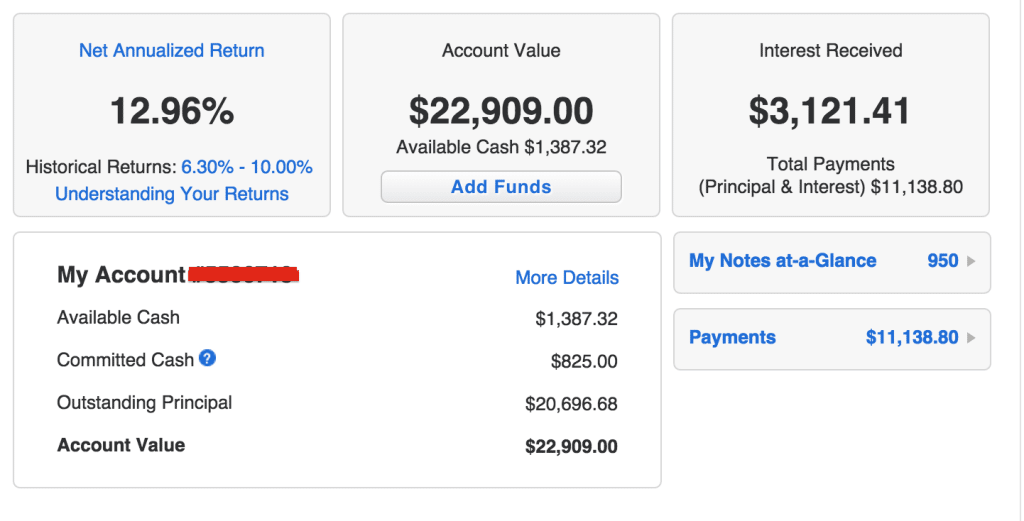

There are various peer-to-peer lending sites on the web already, and more seem to be coming up all the time. But the best established of the lot is Lending Club. Some people who invest on the platform are reporting double-digit interest rate returns.

There is some risk to investing on peer-to-peer sites, but if your interest rates are high enough, you’ll have the ability to cover those risks, and still come out well ahead of more traditional fixed income investments. Get a full explanation of how to use peer to peer in my lending club reviews for borrowers and investors.

Another peer to peer lending option is Prosper. I experimented by opening accounts with both of them over a year ago and I have been very pleased with my returns. Learn more about P2P lending here.

2. DIY Stock Market

Most people seem to prefer to invest their money in mutual funds, particularly when it’s a relatively small amount of money. But if you’ve been showing real ability to make money trading stocks on your own, this might be an opportunity to take that up to the next level.

Most people seem to prefer to invest their money in mutual funds, particularly when it’s a relatively small amount of money. But if you’ve been showing real ability to make money trading stocks on your own, this might be an opportunity to take that up to the next level.

You can open an online discount brokerage account through companies like Scottrade and Etrade. These platforms have all the tools that you need to become a sophisticated investor, including educational resources if you need it. And the low fees are a godsend when you’re trading individual stocks.

3. Build Your Own Motif

Speaking of mutual funds, if you’re looking for a different kind of fund – like really different – check out an investment platform called Motif. This is a platform where investors come to create very unique funds, or motifs. You can invest in some out-of-the-box motifs, such as rising interest rates, solar energy in China, or a looming natural gas glut.

Speaking of mutual funds, if you’re looking for a different kind of fund – like really different – check out an investment platform called Motif. This is a platform where investors come to create very unique funds, or motifs. You can invest in some out-of-the-box motifs, such as rising interest rates, solar energy in China, or a looming natural gas glut.

With a minimum of $250 and for a fee of $9.95, you can even build your own custom motif with up to 30 individual stocks, based on whatever investment niche interests you, and whatever stocks you put into it.

Check out my Grow Your Dough Throwdown 2.0, where I invited a bunch of financial bloggers to join me in creating their own motifs.

4. Auto-pilot investing

If you want to put your money into a virtual autopilot situation, Betterment maybe exactly what you’re looking for.

It’s an online investment management platform, often referred to as a robo advisor, because everything is handled automatically for you. Investment selection, asset allocation, rebalancing, tax loss harvesting – it’s all done for you, and at very reasonable fees.

It’s an online investment management platform, often referred to as a robo advisor, because everything is handled automatically for you. Investment selection, asset allocation, rebalancing, tax loss harvesting – it’s all done for you, and at very reasonable fees.

For example, the annual management fees just 0.35% – or $35 – on an account up to $10,000. And it drops to 0.25% when you exceed $10,000, all the way down to 0.15% when you reach $100,000.

$10,000 won’t buy you much in the way of diversification with individual stocks, but it will be plenty with Betterment.

5. Invest in Some High Yielding CD’s

If you want to be completely safe, you can invest the money in high-yielding CDs. These days the best CD rates are coming from online banks. One of the best in the field is a Capital One 360 Account. They have online checking, savings, and certificates of deposit, all of which pay rates that are higher than traditional brick-and-mortar banks.

But they also have all of the advantages of traditional banks, including a debit card and ATM access. Your deposits are covered by FDIC insurance up to $250,000. And you have all of the benefits dealing with a reputable bank, because that’s exactly what these online banks are.

6. Real Estate

Real estate is an excellent investment, no doubt about it. But $10,000 isn’t enough to make a down payment on the purchase an investment property these days, not in most markets (unless your my buddy that’s mastered buying real estate with no money down). But that doesn’t mean that you can’t invest in real estate.

One way to do it through real estate investment trusts (REITs). These investments have several advantages over owning property outright, including:

- High liquidity – you can buy and sell shares in REITs much the same way you trade stocks

- Diversification – REITs represent a portfolio of commercial properties or mortgages, rather than in a single piece of property or mortgage

- High income – the dividends paid by REITs are usually well above the dividend yields on stocks, and in a different stratosphere compared to certificates of deposit

- Tax advantages – REITs don’t sell properties nearly as frequently as mutual funds sell stocks; the net result is much lower capital gains

- You don’t have to get your hands dirty – anyone who has ever owned an investment property can appreciate this advantage

If you prefer to own property, you can consider pooling your $10,000 with one or more other investors, and buying an investment property outright.

7. Coaching Programs

When we think of investing, we generally think of putting money into assets with the hope of getting a return on the investment. But the best investment that you can make are the kinds that you make in yourself. Anything that you can do to improve your knowledge and skills – that will either enable you to live better, or to earn more money – is a true investment.

One of the ways to do this is to put some of your money into coaching programs. This is especially valuable if you are about to take on a new venture, but don’t have much in the way of relevant experience.

If you can sign-up for a coaching program with someone who is actually doing what it is you would like to enter, it will save you a lot of time, effort, and money. As the saying goes, never try to reinvent the wheel.

There are different coaching programs covering just about any area you can think of. And while we’re on the topic, check out my Strategic Coaching program to see what it can do for you. I absolutely love it!

8. Getting a Designation

This is another example of investing in yourself. Whatever your career is, you should be looking to add any necessary designations for your field. They can raise your visibility, your credibility, and the willingness of customers and clients to do business with you.

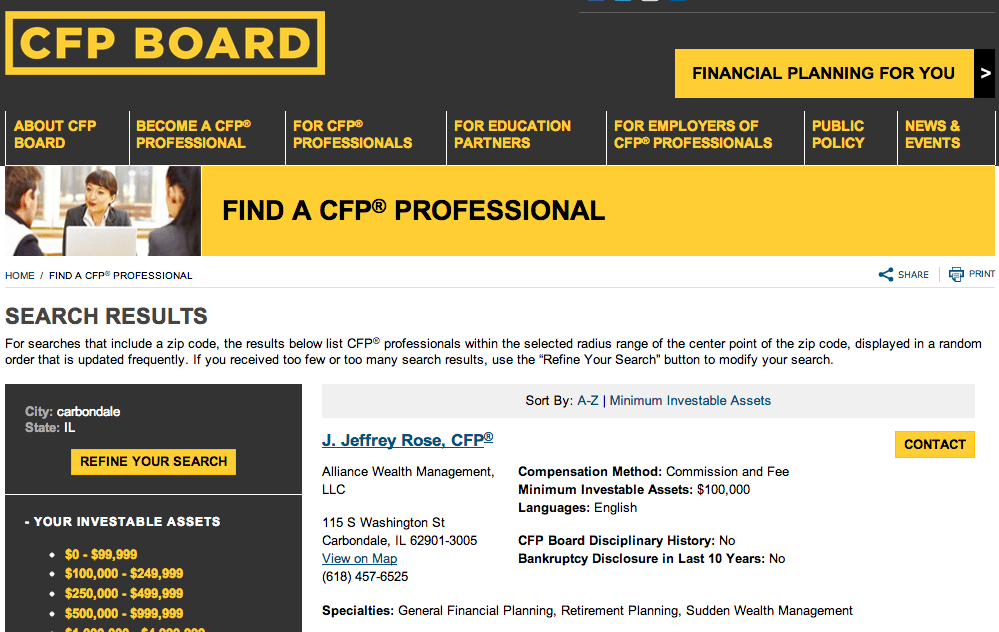

I acquired my certification as a CFP®, or certified financial planner, and it enabled me to launch an entirely new and rewarding career. Find out what certifications represent the top of your field, and invest some money getting a designation for yourself.

9. Going back to school

If you feel that your career is stagnating, and a lot of people do these days, going back to school could be the best investment of time and money that you ever make. $10,000 won’t get you a graduate degree at a name university, but it could cover much or even most of the cost of getting an Associates degree at your local community college.

This could represent the perfect opportunity to retool into a new career, and one that is a lot more relevant in today’s economy.

10. Online Courses

If the idea of returning to school to get a new degree doesn’t appeal to you, or if you are at a point in your life where it’s simply too inconvenient, you should look into taking online courses. There are all kinds of courses available that can help you move into a new career or business.

My buddy Steve Chou has an online course that teaches you how to create an online store. If you have a product or product line that you’d like to sell, this can be the perfect way to learn how to do it online and in your spare time. The program will only cost a few hundred dollars, but it could launch a life-changing business for you.

And then you’ll still have $9,000-plus to invest in some of my other suggestions on this list!

11. Starting Your Own Business

This is yet another example of investing in yourself. By starting your own business, you put yourself in a position to take maximum advantage of your knowledge, skills and abilities. That increases the likelihood of your earning a high income.

Leaving my old brokerage firm and starting my own financial planning practice ranks as one of the best business decisions I’ve made. It definitely had its scary moments, but the rewards have been amazing.

Thanks to the Internet, it’s very possible to start your own business with just a few thousand dollars. Heck, I started this blog for less than $500! Choose the business that you want to go into, study how you can market the business through the Internet, then come up with a business plan. $10,000 should be more than enough to get started with. In fact, starting out you better not spend more than $10,000 to start an online business. There are plenty of ways to start a home based business that require very little up front capital.

One more point in starting a business. When you put money into a given investment, you’re doing so with the idea that it will be worth more money in the future. But when you have a business, it can provide you with an income for the rest of your life. That’s more valuable than just about any other investment that you can make.

12. Starting a Blog

This can be a winning idea on so many levels, and you probably won’t need anywhere near $10,000 to make it happen. Choose a broad topic area – careers, technology, finance, investments, real estate, or just about anything your interested in and have at least above average knowledge – and build a blog around it.

That’s what I did with my blog. As a financial planner it’s been easy for me to tackle personal finance and financial planning related articles on an ongoing basis.

My wife had a different beginning with her blog. It started as a way to document our growing family, but after she realized she could make extra money blogging she started focusing on things that she was passionate about: motherhood, fashion, home decor and our pending adoption. I’m still in amazement at how often her home tour page has been shared on Pinterest – over 1 million times!

The idea is to create a website that will have valuable content that will draw visitors to it. And as it grows, you will have opportunities to monetize it through advertising, affiliate arrangements (essentially, selling other peoples products), or as a platform to sell your own products and services from.

This could be a way of building a side business, rather than taking the plunge into a full-time venture. You can do it as a side line until you are ready to ramp it up to full-time. And you can move at whatever pace is comfortable for you. But once you get going, a blog can be an incredible source of new and exciting opportunities – as well as income.

13. Launching a Podcast

Podcasts are basically blog articles set to audio. But they have the advantage that they can also be placed on other websites for greater exposure. And just as is the case with a blog, there ways that you can monetize podcasts.

The simplest way is to do a series of podcasts and solicit listener donations. This can work beautifully if you have a loyal following. You can also get advertising sponsors, in much the same way that you would for a blog, who would pay for a mention in your podcast, or on the site where the podcast appears.

John Lee Dumas from the top rated podcast on iTunes has made a name for himself with is podcast, Entrepreneur on Fire. John launched his podcast in 2012 and since then has made almost $3 million in revenue! The best part is that he publishes his super highly detailed income reports monthly for those that want to chart his progress. In the beginning much of his revenue was from advertisers and since then he has offered various courses and products for those interested in monetizing their products. This man is truly on fire!

14. Resell Products on Amazon FBA

If you have a talent for finding bargains, but have never had the inclination to sell some of those bargains for profit, Amazon FBA is probably the most hassle-free way to do it.

FBA stands for Fulfillment by Amazon, and that’s exactly what they offer. You deliver the items you want to sell to Amazon, and then market them on the site. Once they have been sold – in the usual way that sales take place on Amazon – the company will handle the shipping for you. It’s one of the easiest ways to run an online business.

In fact, here’s an encouraging story of someone making $500/month extra and only working a few hours a week.

15. Payoff Debt

This is the most risk free way to invest $10,000 – or any amount of money – and it provides a virtually guaranteed rate of return.

Let’s say that you have a credit card with an outstanding balance of $10,000, that has an annual interest rate charge of 19.99%. By paying off the credit card, you will not only get rid of the debt permanently, but you will also lock in what is effectively a 19.99% return on your money.

No, it won’t mean that you’ll be collecting a 19.99% rate of interest as a cash income on your money, but it will mean that you are no longer paying it – which is virtually the same thing.

Here’s another plus: the 19.99% that you will earn on your money (by not having to pay it out every year) is income that you will not have to pay any tax on. If you were receiving 19.99% on $10,000 directly, a large chunk of the income would have to go to pay income taxes every year.

With inflation, $10,000 may not seem like a lot of money these days, but it’s plenty if you want to get into some interesting and imaginative investments. You can use them as an opportunity to grow your nest egg into something much, much larger. It’s even enough for you get into three or four of these investment ideas, which will give you an opportunity to really grow your money.

Give a couple of these a try and see if they’ll work for you!